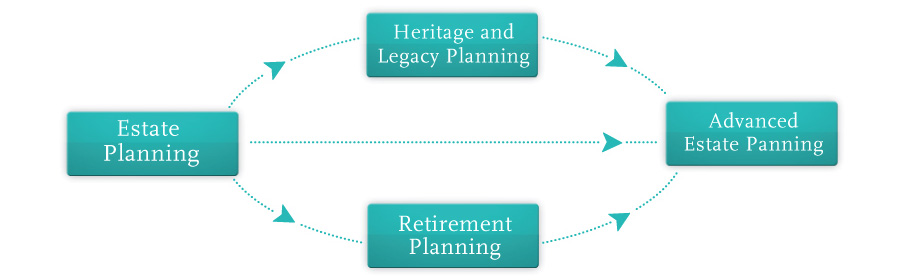

Estate Planning

Our California Trust Attorneys advise in the areas of basic and advanced estate planning techniques.

Core planning ensures that you will be able to control and protect your property while you are alive and well. Furthermore, this level of planning will enable someone else to take care of you (and your loved ones) if and when you can’t. Finally, this plan increases privacy and significantly reduces the delay and cost associated with estate administration.

Heritage trust planning significantly increases the protection available to your children and surviving spouse from creditors and predators. Heritage trust planning may also include the establishment of self-directed trusts for children in order to achieve beneficiary-control along with a degree of asset protection.

Retirement trust planning may reduce the income tax burden that would otherwise result from accelerated distributions from retirement accounts, and create a degree of asset protection for distributions from qualified plans.

Advanced Estate Tax Planning may substantially reduce your estate tax liability through the use of various techniques, including life insurance trusts, annual gifting, split interest trusts, annuity trusts, charitable foundations, and others. Some of these techniques may also offer asset protection.